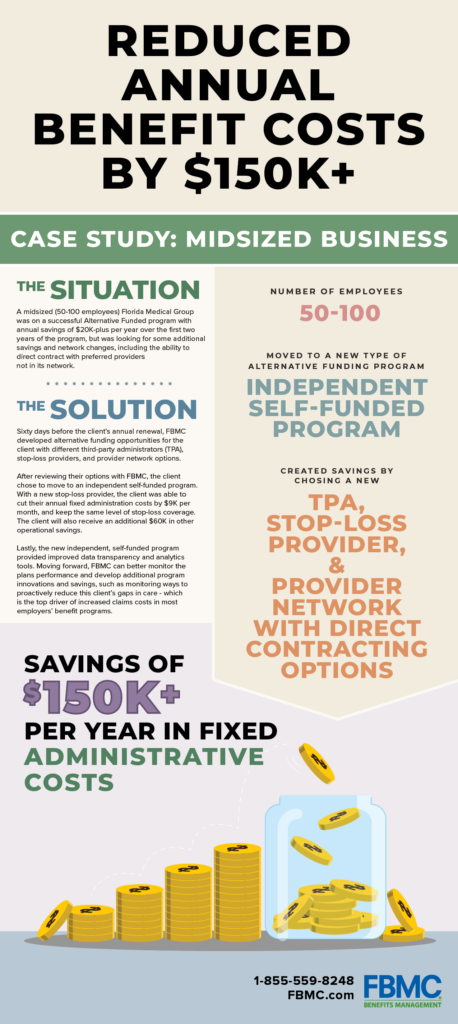

A successful midsized business was looking for savings, service, and a better provider network in their self-funded program. FBMC developed three different options to choose from. We were able improve service by finding a new third-party administrator and a new provider network. We competitively bid stop-loss providers across 20 markets and were able to obtain a new stop-loss provider with the same coverage for a savings of $9k per month. The client will also receive an additional $60K in other operational savings.

The best part of a self-funded plan is the level of customization and savings that are unique to your needs. If you are looking for certain health services or a third-party administrator with a smoother claims process, then self-funded plans are a great place to start.

Self-Funded Options

With a self-funded plan, you have the options and the convenience on the following:

• 100% Data Transparency: pick a TPA that provides 100% claims cost & history, which allows you to understand and lower your claims expenses and future claims reserves.

• Administration tailored to the employer’s needs: With the right TPA the employer has the option to customize both plan document/services covered and their employee experience.

• Cost and utilization controls: The right TPA will offer a second surgical opinion program, an outpatient surgical program, a hospital bill audit program, a large case management program, access to a preferred provider organization (PPO), and other programs through a variety of sources, rather than the employer being able to use only the insurance company’s in-house programs.

• Risk management effectiveness through Stop-Loss insurance: The employer may choose the amount of risk to retain and the amount to be covered by stop-loss coverage. An insurance company has set pooling levels allowing little flexibility.